Navigating Manufacturing Turnover: A Deep Dive into No-Show & Attrition Challenges

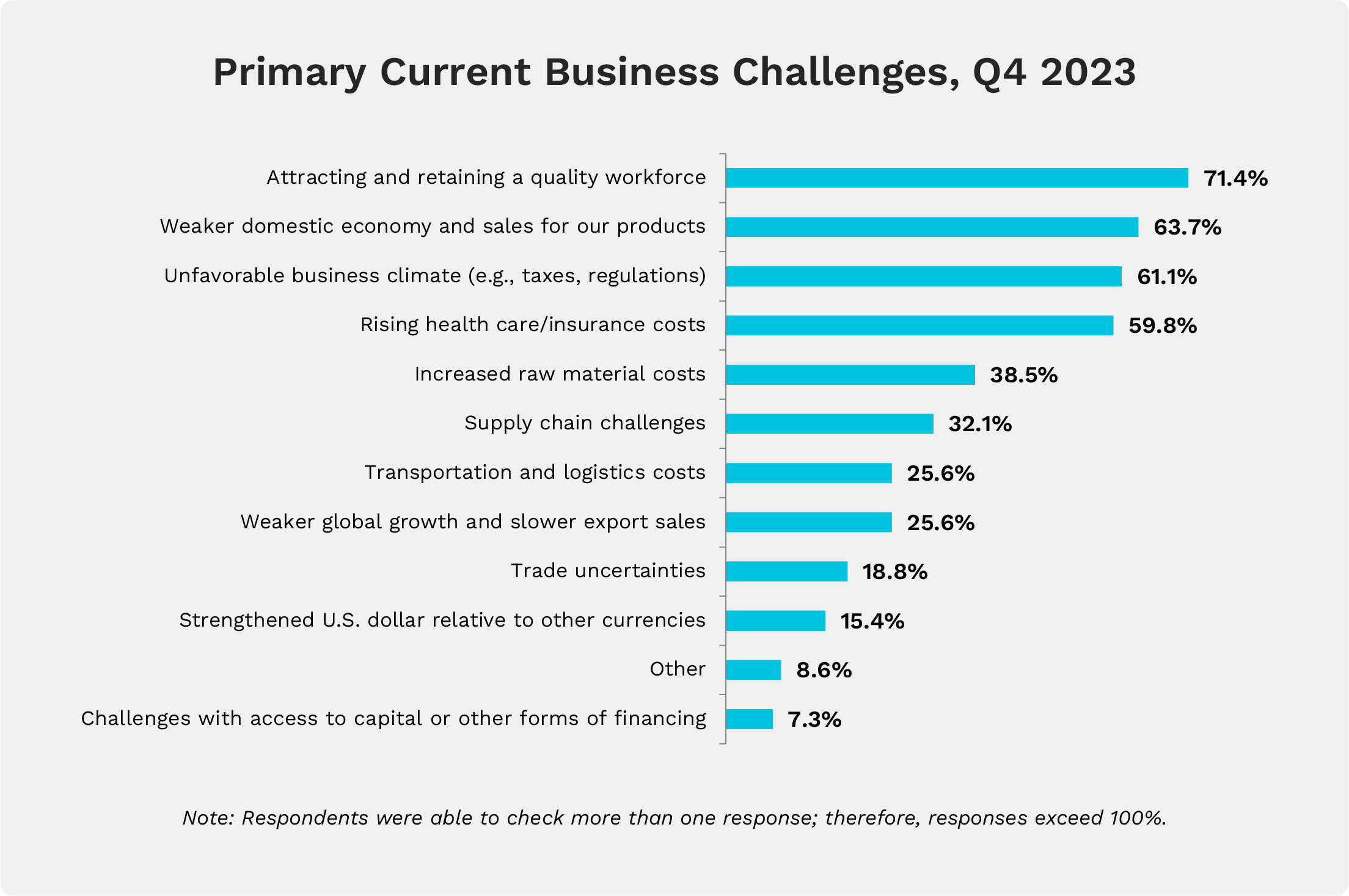

No-shows and attrition in the manufacturing sector are an enduring challenge that Talent Acquisition teams grapple with daily. In the dynamic realm of manufacturing, where precision, velocity, and reliability reign supreme, talent leaders need to understand the harm of attrition and how to overcome it. Within an industry where every workforce member holds significance, attrition transcends mere numbers. For manufacturing organizations, attrition is a palpable force that negatively impacts revenue, forecasts, and future growth trajectories. As per PwC’s 2023 industry report, a staggering 71% of manufacturing leaders identify talent acquisition and retention as substantial risks, especially given the prolonged onboarding procedures and costly specialized training. Notably regarding attrition rate in the manufacturing industry, nearly 40% of manufacturing organizations report frontline attrition rates exceeding 10% (PwC).What's in?

What is attrition? Unveiling the complexity for manufacturing

First, let’s establish a shared understanding of what is attrition in manufacturing, before diving into the intricate landscape. Attrition, fundamentally, denotes the gradual reduction in workforce numbers due to retirements, resignations, or other departures. However, within manufacturing, attrition assumes multifaceted forms based on when this unwanted attrition occurs, presenting distinct challenges necessitating tailored solutions.

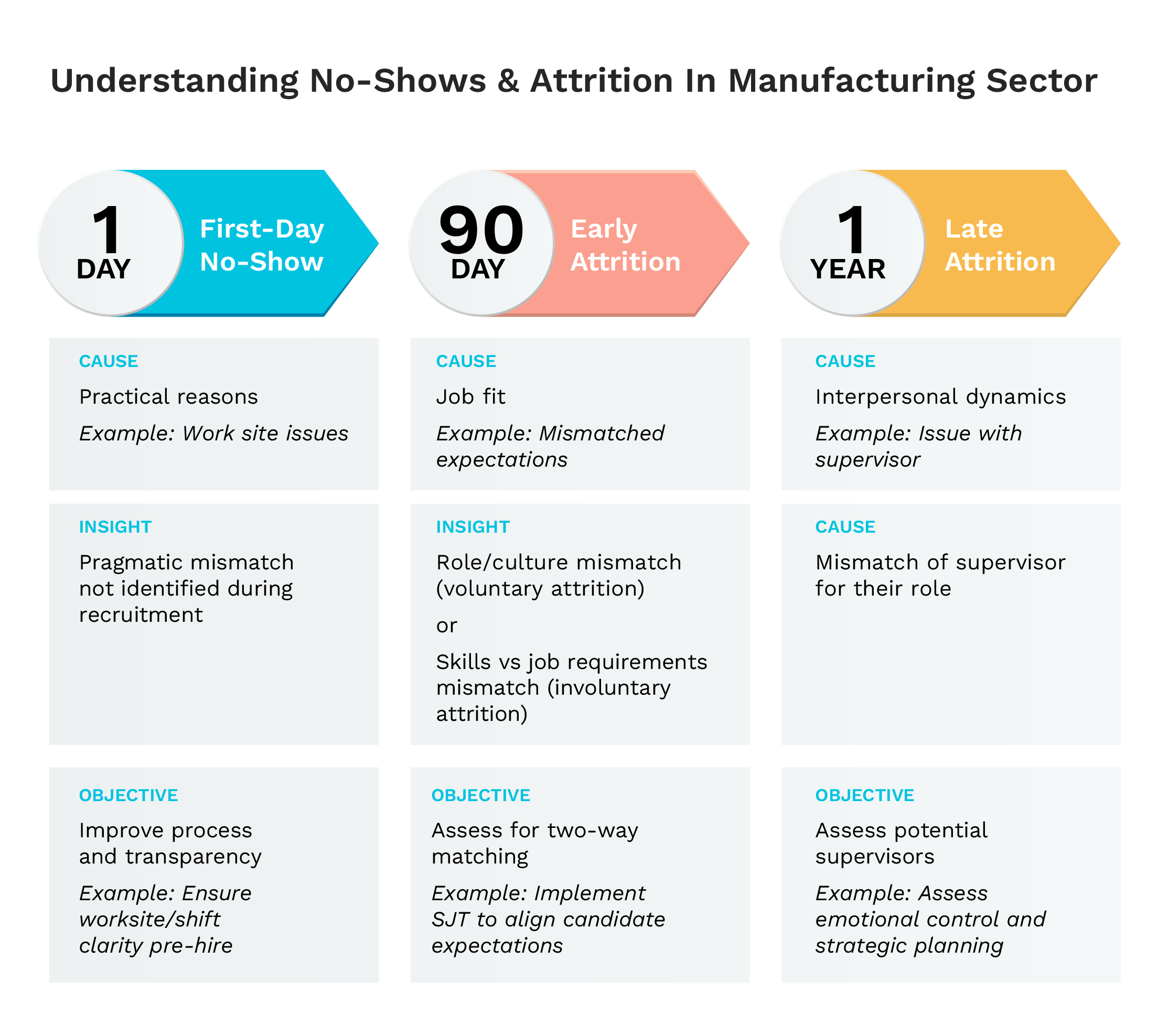

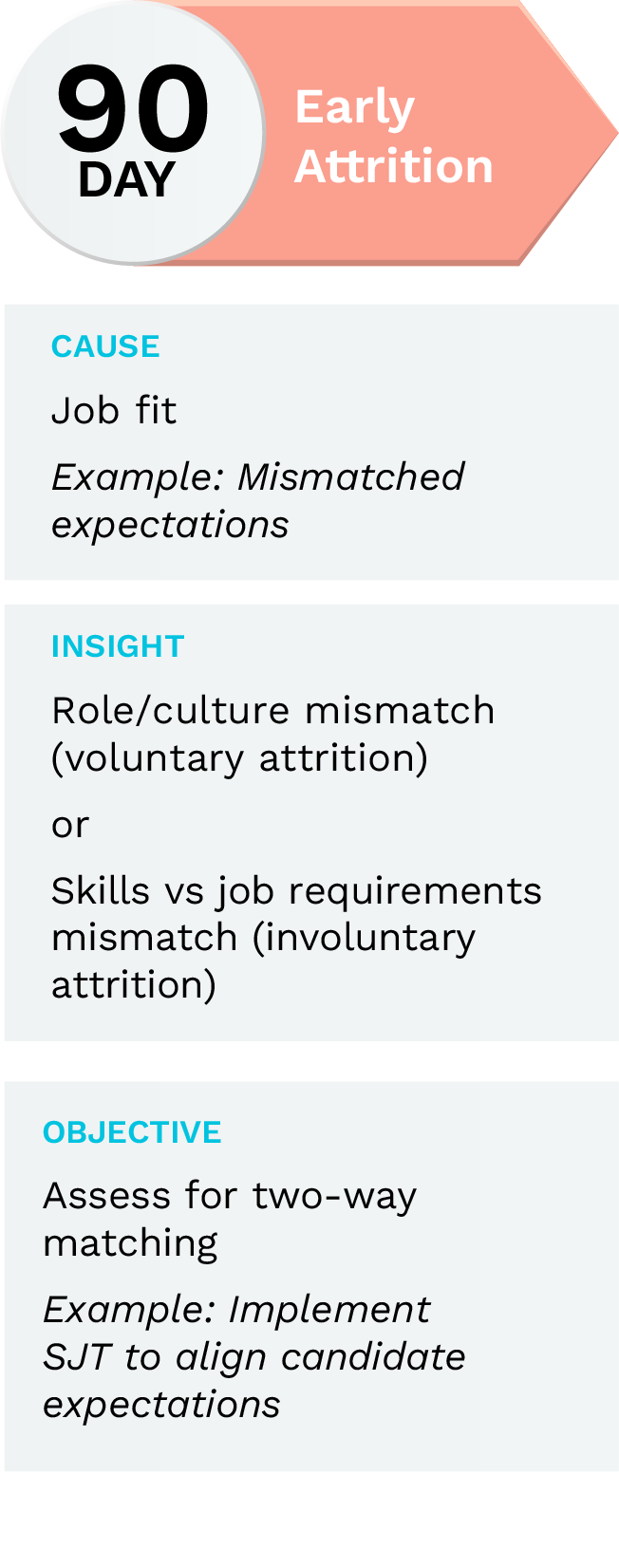

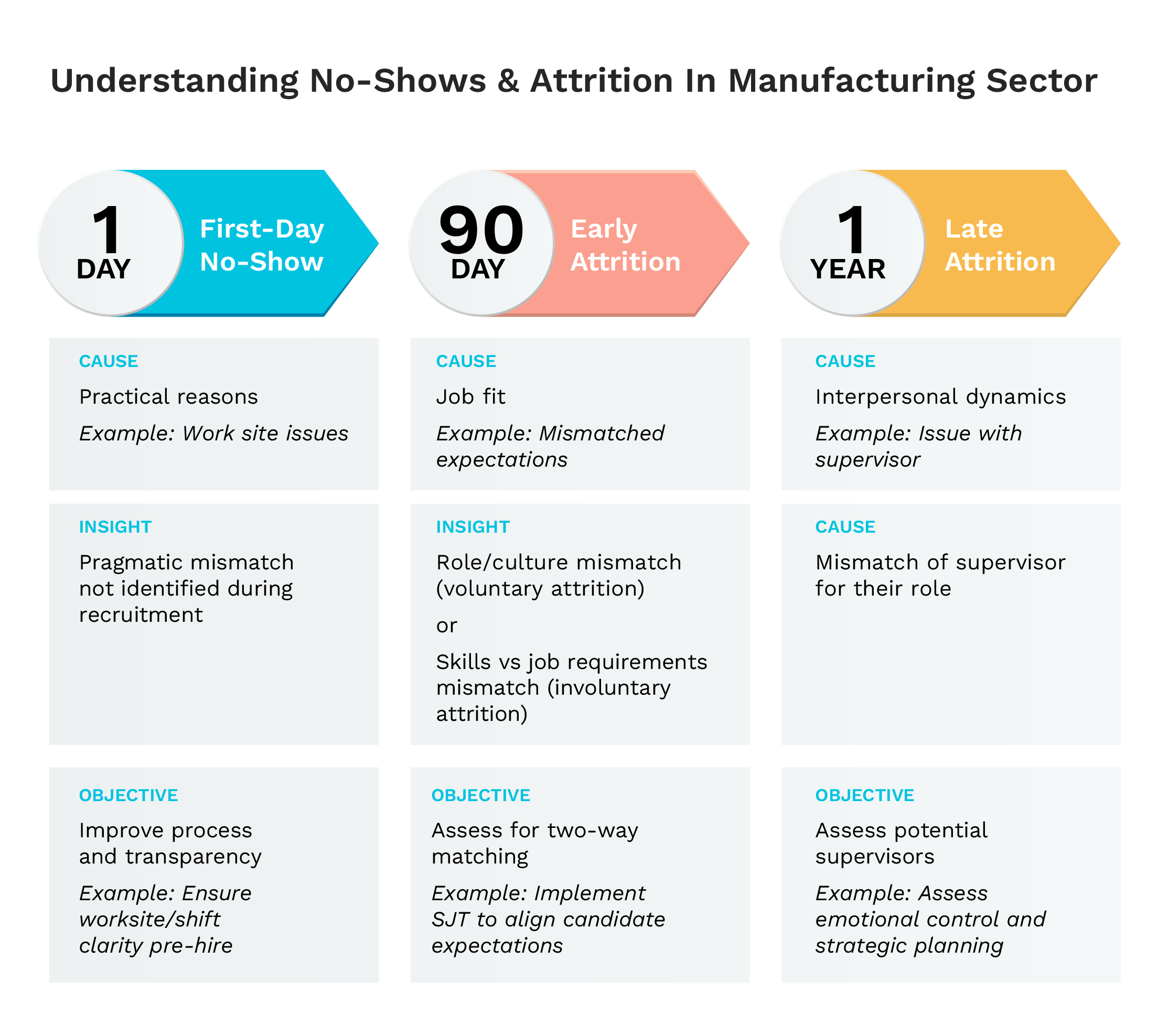

Navigating attrition phases: Day 1 vs Day 90 vs Year 1

First-Day No-Shows

Imagine the anticipation of welcoming new recruits, only to find some absent on day one. First-Day No-Shows pose a confounding facet of attrition, disrupting the onboarding process. This initial departure often signals recruitment issues, misaligned expectations, or vague job roles.

Early / 90-Day Attrition

After the initial onboarding flurry, a subsequent wave of attrition may surface around the 90-day mark. Employees departing within this period indicate potential mismatches between individuals and the organization. It’s a critical juncture where expectations meet reality, demanding a nuanced grasp of workplace culture and support systems.

Later Stage Attrition (Around the 1-Year Mark)

Just as your workforce attains momentum, later-stage attrition emerges. Departures around the one-year mark may signify deeper concerns like burnout or dissatisfaction with growth opportunities or company culture. Addressing these issues necessitates a comprehensive approach, emphasizing long-term engagement and professional development.

Tailoring Solutions to Each Phase

Recognizing the nuanced nature of attrition empowers HR professionals to deploy targeted strategies. It’s not a one-size-fits-all scenario but a call to address underlying issues at specific stages.

In the ensuing sections of this blog post, we’ll delve into each attrition type, offering actionable insights and best practices for mitigating talent turnover. From refining recruitment strategies to fostering continuous growth, our aim is to equip you with the tools to navigate attrition challenges in the manufacturing HR landscape.

Read on to learn how your organization can mitigate First-Day No-Shows and unwanted attrition during the 90-day and 1-year phases.

Securing Day-1 Retention: A Strategic Blueprint

According to a study by UKG and the Workforce Institute, the average cost of turnover for a skilled frontline manufacturing employee is $20,000 – $40,000 (USD). When combating First-Day No-Shows, reframing this attrition as late-stage recruitment drop-off proves beneficial. It’s particularly costly, as it occurs late in the recruitment cycle after all recruitment costs — and some onboarding costs — have already been spent.

Causes of First-Day No-Shows often include:

- Economic pressures compelling candidates to accept initial offers.

- Insufficient candidate-centric approaches, leading to uncertainty and communication gaps.

- Misaligned training and onboarding schedules conflicting with candidates’ responsibilities.

To address these challenges, organizations should:

- Enhance Transparency: Clearly communicate worksite details and shift expectations during recruitment to aid informed decision-making.

- Expedite Time to Hire: Streamline recruitment processes, leveraging assessments and automation like interview scheduling, to reduce time-to-fill.

- Engage Early with On-Site Interviews: Automatically schedule on-site interviews to provide candidates with firsthand insights, fostering connection and reducing uncertainties.

- Maintain Consistent Communication: Keep candidates informed post-offer acceptance to ensure a welcoming experience before training begins.

By proactively addressing these factors, manufacturing organizations can fortify their recruitment strategies against day-one no-shows, ensuring smoother onboarding processes and fostering long-term commitment from their workforce.

Ensuring Day-90 Retention

Nearly two-thirds of manufacturing new-hire turnover occurs within the first 90 days. Unlike First-Day No-Shows, early-stage attrition, post-hire, stems from different causes. However, let’s first understand its significance.

Every hire has a breakeven day, a point where their contribution equals their output. In manufacturing, given prolonged and costly onboarding that often requires specialized training, this break-even typically occurs later than in other roles, rendering this attrition particularly expensive.

Early-stage attrition also burdens colleagues, impacting morale and productivity, potentially triggering further attrition.

So, what causes 90-day attrition?

Voluntary attrition often stems from mismatched expectations regarding role, environment, or culture. Candidates may find the day-to-day role differs from their expectations post-hire.

Involuntary attrition indicates a mismatch between employees’ skills and job requirements, misrepresentation of minimum job requirements, or a lack of employee adaptability or conscientiousness.

How to Safeguard for Early Attrition

Better assessing candidates during recruitment is key. Utilize realistic job previews and situational judgment tests to align candidate expectations with the role.

Assessments can gauge specific skills, knowledge, and problem-solving abilities required for the job. For instance, personality assessments like Harver’s traditional behavioral assessment can determine candidates’ safety orientation, detail orientation, and openness to learning. Cognitive ability tests, particularly spatial cognitive ability tests, can predict assembly efficiency, contributing to the bottom line.

Quality assessment providers tailor assessments to your environment and candidate profile, balancing speed and quality of hire to reduce attrition costs.

By implementing these strategies, manufacturing organizations can bolster their recruitment efforts, minimizing attrition and fostering a committed workforce poised for long-term success.

Like what you see?

Don’t miss out. Subscribe to our quarterly digest to get the latest TA and TM resources delivered right to your inbox.

Securing 1-year retention

While we’ve delved into the intricacies of First-Day No-Shows and early attrition, late-stage attrition, which occurs around the 12-month mark and beyond, presents distinct causes and remedies. Regardless of time frame, impact on profit can’t be overstated: 7 in 10 manufacturers say turnover has moderate to severe impact on their bottom-line finances.

Protecting year-1 retention is paramount. While First-Day No-Shows impact Talent Acquisition budgets, and early-stage attrition arises from mismatched expectations, attrition at the 1-year mark significantly impacts production output. The extended onboarding time in manufacturing, often involving hands-on learning from colleagues, renders attrition at this stage notably costly. Consequently, performance, delivery times, and production output suffer.

What Drives 1-Year Attrition?

While First-Day No-Shows and early attrition primarily stem from recruitment challenges, later-stage attrition is often rooted in management and team dynamics.

Common reasons for attrition beyond the 12-month mark include:

- A lack of support,

- Conflicts with supervisors or colleagues, and

- Life changes such as caregiving responsibilities/arrangements.

While some cite new opportunities closer to home, research indicates that frontline employees generally don’t seek alternative employment unless somewhat dissatisfied with their current situation.

Strategies to Safeguard Retention at 12+ Months

While candidate assessments play a limited role in addressing late-stage attrition for frontline employees, behavioral assessments during recruitment offer valuable insights into the alignment between candidate ambition and advancement opportunities within the organization. Balancing ambition levels is crucial, as excessive ambition may lead employees to seek opportunities elsewhere shortly after acquiring basic skills post-onboarding.

Supervisor assessments are pivotal in minimizing late-stage attrition. Manufacturing organizations can evaluate potential supervisors’ emotional control, empathy, and strategic planning abilities. By focusing on these aspects, organizations can foster supportive environments that reduce attrition and promote long-term retention. Another option is to enable self-serve leadership development, like UPS.

Conclusion

In the dynamic landscape of manufacturing, where precision and reliability are paramount, Talent Acquisition teams face an ongoing battle with attrition. As we’ve explored, attrition isn’t just a numerical concern because it’s a tangible force impacting revenue, forecasts, and growth trajectories. With PwC’s 2023 industry report revealing significant risks associated with talent acquisition and retention, it’s evident that addressing attrition is critical for sustained success.

Navigating attrition in the manufacturing sector is a multifaceted endeavor requiring strategic interventions at every stage. By adopting tailored solutions and fostering supportive environments, organizations can mitigate attrition’s impact, ensuring a resilient and engaged workforce poised for long-term success.

To learn more about how situational judgment tests, realistic job previews, and behavioral assessments can dramatically reduce unwanted attrition for manufacturing, request a demo now. With so much on the line when it comes to your assembly line, can you afford not to?