With jobs in the finance industry expected to grow by 10% by 2026, it’s more important than ever that financial recruiters know how to find and hire talent in today’s competitive hiring market.

But financial services recruitment is very specific. It comes with a unique set of challenges and requirements that make it very difficult to find the right people (with the right skills) for open roles. When recruiting in the finance industry, your strategies have to be on point to land the best candidates—but how do you know the right steps to take?

We’ll break down the key financial services recruiting challenges and share tips and tricks to help with your hunt for great finance hires!

What’s included?

- What are the key challenges in financial services recruiting?

- What steps can you take to nail financial services recruitment?

- Improve your employer branding

- Employ recruitment marketing strategies

- Expand on your sourcing strategy

- Have a graduate recruitment strategy in place

- Implement inclusive recruitment principles

- Build a corporate alumni network

- Work growth and inclusion into your EVP

- Connect through email and social media

- Start an employee referral program

Like what you see?

Don’t miss out. Subscribe to our quarterly digest to get the latest TA and TM resources delivered right to your inbox.

What are the key challenges in financial services recruiting?

Every industry faces its fair share of challenges when recruiting new candidates—but financial services recruitment takes the cake. From ever-evolving technology continuously changing business needs and having to find people with niche skills to intense competition from both “fintech” (financial technology) companies and other sectors entirely, it’s no wonder recruiters struggle with financial services recruiting.

Here are some of the top challenges that companies face with financial services recruitment:

Shortage of suitable candidates

76% of accountancy and finance employers said their top challenge in recruiting is a shortage of suitable applicants. Talent is in short supply and has been for a while now. Because of this, financial services employees are increasingly hard to find—not to mention even harder to keep!

Lacking the right specialty skills

Corporate finance departments are looking for more than just number crunchers—they need to hire people with specialist skills to ensure their needs are met. However, looking for niche skill sets is already difficult, let alone when there’s a serious shortage of candidates on the market.

9 out of 10

CFOs report difficulties finding professionals with requisite skills.

Source: Robert Half

Finding and hiring skilled professionals in Accounting & Finance is due to a lot of demand for such employees and limited supply.

Fierce competition for talent

Chances are, you’re competing with many other sectors for great talent—especially with so many of today’s young employees pursuing jobs in tech over finance. Competing against so many different companies across multiple industries makes financial services recruiting more difficult than ever before.

Rapid digital transformation

Technology continues to adapt in new and unexpected ways that change the financial services industry—not to mention what companies are looking for when hiring for open roles. With so much changing all the time, recruiters in the financial sector face constant challenges.

75%

of CEOs in the financial services sector are concerned about shortages of digital skills within the industry.

Source: PwC

3 in 4 CEOs also worry about the lack of these skills within their own workforce.

What steps can you take to nail financial services recruitment?

Despite these challenges, there are several steps you can take to get ahead of the competition and recruit awesome finance hires:

1. Improve your employer branding

Investing in your employer brand is essential if you want to compete for talent and stand out in the crowd. Research how your potential candidates perceive your brand and what they really want to know; then identify how it differs from what you’re showing them. See what you can do about it and how you can influence their perceptions to appeal to more candidates.

Bear in mind that you’re competing with young fintech companies who likely have a fun, engaging employer brand. To truly be competitive, you’ll need to market your company in a way that reaches your ideal candidates. After all, as Matthew Jeffrey, Global Head of Sourcing and Employment Brand at SAP put it: “Recruitment IS marketing. If you’re a recruiter nowadays and you don’t see yourself as a marketer, you’re in the wrong profession.”

2. Employ recruitment marketing strategies

And the marketing doesn’t stop with building your employer brand. Recruiters have to focus on targeted strategies to build a large talent pool of qualified candidates for current and future hiring needs.

Applying recruitment marketing techniques is a sure-fire way to appeal to job seekers and find the specific skills that your company requires. To do it effectively, you have to get creative and come up with new ways of reaching candidates. Nurturing your candidates with relevant digital content and engaging recruitment campaigns is a great way to get and keep their attention.

You can also use digital tools like programmatic job advertising to help you get your openings (and your company) in front of the right people. This will help you target the candidates who possess the precise skills the job requires. Additionally, creating ideal candidate profiles also helps with strategically identifying the attributes you’re looking for in applicants.

24%

of organizations in the financial services sector use changing brand perception through marketing and advertising as a strategy to access digital talent to a large extent.

Source: PwC

46% of companies use this tactic to at least some extent.

3. Expand on your sourcing strategy

To find the best financial services professionals out there, you need to be looking in all the right places. That’s why expanding on your sourcing strategy is a great place to start—but doing so can be easier said than done.

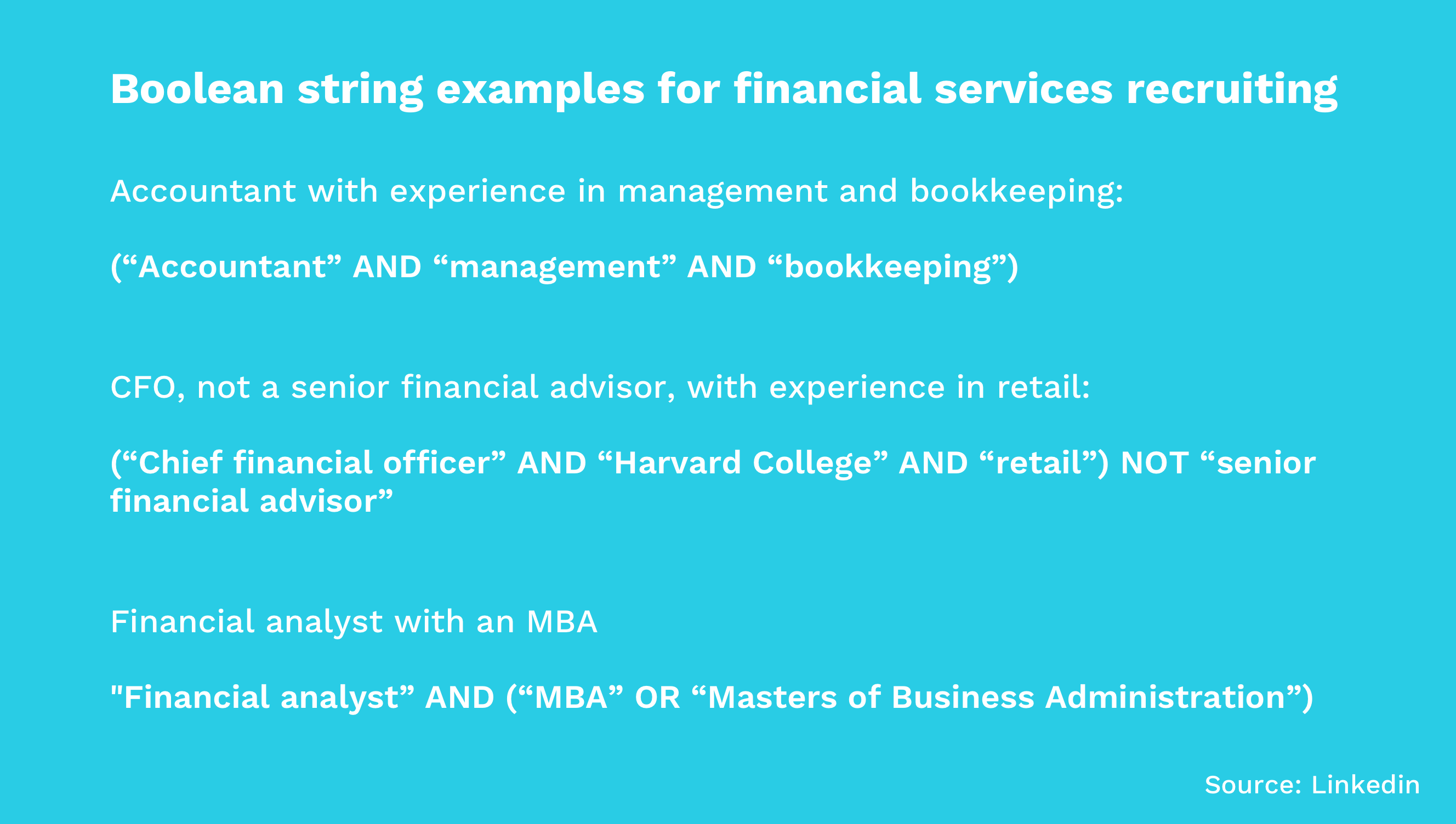

Make sure to advertise your openings at relevant places as possible, such as social media sites and online job boards. 71% of finance and accounting professionalssaid they most frequently search for work through online job boards. Post to general job boards like Indeed, as well as specialist job boards for financial services like eFinancialCareers, CareerBank, BrokerHunter, and FinanceJobs. You can also post open roles and look for people at Linkedin.

Tap into as many diverse sources for candidates as possible. College graduation fairs and other recruiting events are a great way to get out in the community and meet entry-level candidates. If you’re struggling, you can also hire a specialist recruiting agency to help you. There are also several types of recruiting software that can improve your efforts and make your job easier.

4. Have a graduate recruitment strategy in place

Companies in the financial services industry are among the largest employers of entry-level candidates. That’s why most finance recruiters probably already have some type of graduate recruitment strategy to find new graduates who are just entering the workforce.

While that alone is a great start, it’s not enough to be competitive in such a crowded hiring market—let alone to retain talent once you bring them on board. Have a process in place for recruiting college graduates, but don’t stop at just hiring them. Make a continuous effort to work on honing their skills and developing them into future leaders who will help move your organization forward. As Virgin CEO, Richard Branson, famously put it: “Train people well enough so they can leave, treat them well enough, so they don’t want to.”

5. Implement inclusive recruitment principles

It’s no secret that the finance industry struggles with diversity. In fact, a recent survey found that less than a quarter of participants are aware that their employers are actively trying to recruit more women and people from minority groups. While finance companies are slowly progressing and recruiting more diverse candidates, many are still falling short and proving there’s still room for improvement—and that’s where you come in.

There are a ton of different ways you can implement more inclusive recruitment principles. For example, try writing inclusive job ads to attract diverse candidates and utilizing principles of blind hiring to eliminate unconscious human biases. Make it a point to hire employees based on skills and characteristics to ensure they’re closely aligned with what you’re looking for.

Also, don’t forget to share your efforts with current and potential employees! As you work on diversifying your workforce, showcase it to appeal to more diverse candidates in the future.

68%

of Millennials in the financial sector said that while companies talk about diversity, they felt that opportunities weren’t equal for all.

Source: PwC

Finance organizations are working on increasing diversity within their workforce, however, there is still a long way to go.

The state of diversity recruiting in 2020

6. Build a corporate alumni network

A lot of financial services recruiters have trouble hiring mid-career professionals. Many former employees left the industry during the recession and never came back out of fear. But why burn a bridge that doesn’t need to be burned?

A great way to stay in touch with talented professionals is to build a corporate alumni network that allows you to reach any former employees who left under positive circumstances. Consider creating a digital group on LinkedIn or Facebook that you can use to communicate with former employees that may turn into rehires. You can also look into implementing a corporate alumni platform.

This will help you maintain positive relationships and keep your hiring funnel healthy in the process!

7. Work growth and inclusion into your EVP

It’s nice if you hire diverse employees and all, but what do you do once they’re working for you? You have to have a proper professional development program, with diversity initiatives that work.

Working growth and inclusion into your company’s employee value proposition (EVP) is a great way to demonstrate your commitment to helping employees grow professionally.

Furthermore, even if you have inclusive recruitment practices in place, bear in mind that it’s not enough just to hire diverse employees—you have to empower them to succeed by offering the right tools, resources, and opportunities to drive their professional development. Your commitment to building an inclusive working environment has to be an integral part of your employer value proposition.

8. Connect through email and social media

With so many digital tools available to us, it only makes sense to use them for recruiting efforts. Connecting with job candidates through email and social media platforms is a highly effective way to reach modern applicants—especially the younger generations.

Email marketing is a great tool for staying in touch with professionals in financial services. Even when promising candidates don’t make the cut, you can still maintain a relationship by sending emails to nurture candidates and keep them in the pipeline for open roles.

Social media sites like LinkedIn, Facebook, Instagram and Twitter are also great places to connect with candidates. In fact, a LinkedIn study found that 49% of professionals are following relevant organizations on social networks to keep pace with their recruitment processes. Why not reach them where they’re already actively looking?

JP Morgan took their social media recruiting even further and they used Snapchat to attract entry-level candidates. Their geofilters campaign garnered 3.1 million views and the whole recruitment video series resulted in over 17.5 million views.

38%

of financial services organizations communicate their diversity strategy and diverse employees via their social media channels.

Source: PwC

Social media is a good place to present your D&I strategy and attract candidates from all backgrounds.

9. Start an employee referral program

Who better to find the best candidates than friends and family that already work for you? Employee referrals are an excellent way to reach new talent. In fact, many use employee referrals as their primary recruiting method! Past studies have even shown that this recruiting practice has been the most effective for recruiting younger generations.

Consider starting a referral program that rewards existing employees for recommending professionals that they feel would make great candidates. This practice improves time to hire and is saves on recruiting costs because it you’re not spending valuable resources on sourcing. At the same time, you’ll gain new employees who already jive well with your existing team and culture. (Win-win!)

One last thing

There’s no doubt about it: Financial services recruiting is hard. Talent is scarce and competition is fierce. That’s why you have to be proactive with your recruitment strategies to attract the best candidates for financial services roles. It all starts with showing them what your organization stands for when recruiting both graduates and seasoned professionals. Once you do that, everything should fall into place and you should be hiring rockstar finance employees in no time!

The state of diversity recruiting in 2020